Warranty Analytics is the Key to Detecting and Preventing Dealer and Servicer Fraud

Warranty Fraud – What is it? Why does it happen? What can you do about it?

Occupational fraud – which includes dealer or servicer fraud – is defined by the Association of Certified Fraud Examiners (ACFE) as:

“the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets.”

The size of dealer and servicer fraud in the U.S. is substantial. Although the true size of warranty fraud is unknown (a large number of fraud cases are never reported), warranty fraud is estimated to be as high as 10% of warranty expenses or 2-4% of company revenues annually. With total warranty expense by U.S.-based companies at $25 billion in 2017¹, dealer/servicer fraud can be estimated at $2.5 billion annually.

Manufacturers face many types of dealer and servicer fraud, including but not limited to: over-charging for repair, conducting repairs right before the warranty period ends, replacing car parts instead of repairing them, charging the manufacturer and consumer for the same repair, making false representations of part quality, substituting lower cost parts in order to maximize margin, submitting multiple invoices for parts/work, and submitting false or inflated invoices.

Key drivers of dealer / servicer fraud

1. Insufficient internal fraud controls.

Warranty fraud can be difficult to detect, especially without skilled resources, processes and controls in place – e.g. internal audit departments, anti-fraud policies, and formal fraud risk assessments. High turnover can lead to a situation where there may be processes and controls in place, but they are not known or followed. In addition, timeliness and quality of warranty data may make it difficult to conduct effective audits.

2. Sensitivity of discussing warranty fraud.

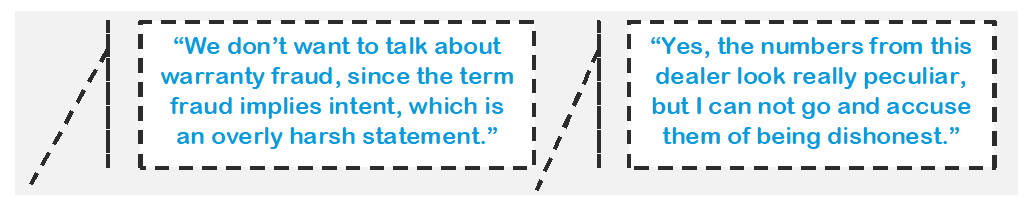

For many manufacturers, the hurdle from initial suspicion to taking confident action can be significant. Most manufacturers do not want to believe one of their dealers or servicers could be fraudulent. In addition, many manufacturers rely on their dealers for a majority of their revenue streams, making it difficult to confront them without overwhelming evidence. From a brand reputation standpoint, companies may not want to risk going public and admit to being “duped”.

Figure 1: Manufacturers are hesitant to confront dealer fraud

Source: Warranty Fraud Management: Reducing Fraud and Other Excess Costs in Warranty and Service Operations, Kurvinen, Toyryla, & Murthy, June 2016.

3. Lack of automated, real-time claims monitoring.

There are many manufacturers who still conduct manual claims audits. This can be extremely time-consuming and resource-intensive, not to mention that individual auditors can miss major fraud patterns if they only see a portion of the overall claims.

Rules-based adjudication systems help automate the process and provide a centralized, objective funnel for all claims to pass through before being approved. These systems can identify issues in real-time – but they focus on “known” patterns like invalid failure codes, labor hours that exceed the benchmark, high frequency of repairs by a specific dealer, or wrong parts being ordered for a specific type of repair.

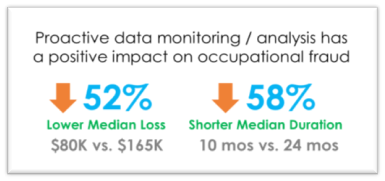

Figure 2 highlights two benefits of utilizing proactive data monitoring to detect fraud. In ACFE’s 2018 report, those organizations who implemented some form of proactive data monitoring showed significantly lower fraud losses and much shorter median durations.

Figure 2: Impact of warranty data monitoring/ analysis on median fraud loss & duration

Source: ACFE 2018 Report to the Nations: “Global Study on Occupational Fraud & Abuse”.

Building an effective fraud detection/prevention process

Experienced warranty analytics providers like After Inc., work with manufacturers to develop an objective, automated, and effective fraud process.. This process involves five key steps: Gather-Integrate-Evaluate Data, Establish Benchmarks, Identify Deviations, Conduct Additional Text-Based Analysis for Validation, and Determine Appropriate Communication.

1. Gather, Integrate & Evaluate Data

The first step in building a sound process is to gather and integrate all relevant claims data from both inside the manufacturer –across product, supply chain, call center, etc. – and from third party partners including dealers and servicers. This requires a warranty data expert like After, Inc. who is familiar with warranty data and terminology, and can upload and match large warranty data sets – both structured and unstructured – and detect and correct inconsistencies like missing fields, data mis-categorizations, and data misspellings. Accurate findings necessitate accurate and complete data sets.

2. Establish Benchmarks

The next step involves working with the manufacturing client to establish benchmarks for each type of repair based on parts and labor costs as well as repair efficiency. This often involves significant modeling to make it easier to compare dealers or servicers in different geographic areas or with different product mixes.

3. Identify Deviations

Next comes the advanced analytics to detect anomalies in the data. In order to uncover anomalies, warranty data analysts look at the data nationally, as well as broken down by region, by model/sub-model, by repair type, by dealer/servicer, and by warranty quarter.

There are various types of warranty analyses that are performed during this step, including: cost driver analysis, causal part analysis, referencing pareto charts, root cause analysis (e.g. serial range analysis, service repair heatmaps), and dealer and servicer performance analysis utilizing statistical models.

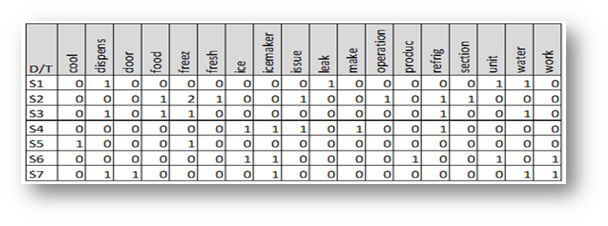

4. Conduct text-based analyses to validate fraud

An important step in any warranty analytics process is to conduct text-based analysis, that can show potential inconsistencies between dealer/servicer/customer comments and repairs performed. The analysis starts by turning comment-based data sets into tables called Document Term Matrices (DTMs). DTMs plot individual comments (called observations) as rows and commonly used words as columns. Before building DTMs, misspelled words must be corrected and words must be collapsed to their roots, a process known as “stemming.” In addition, rules must be written for compound words, such as “water pump” and “waterpump” so they do not appear as three separate words in the DTM columns. Though time consuming, these DTMs are extremely valuable – as words are converted to zero’s and one’s which allow warranty analysts to determine frequencies and correlations. These frequencies can then be leveraged to calculate consistency metrics to identify outlying claims.

Figure 4: Example of a DTM for an appliance manufacturer

Text-based analysis can be extremely helpful in determining root causes. One analysis might show that repairs on a tractor which were performed under a service contract, should have been identified as pre-existing conditions and repaired prior to the sale. Another analyses might identify that an automobile engine or transmission that was replaced under the manufacturer’s warranty should have been repaired instead. And another analysis might uncover that appliance parts were being repaired pre-maturely in order to fall within the maintenance contract period.

For more information on text-based warranty analysis, you can read an article we developed for Warranty Week last July called “Text Analytics for Warranty Claim Comments”.

5. Execute a thoughtful communication plan

Once dealer or servicer fraud has been validated and evidence is in hand, the manufacturer can address the dealer(s) or servicer(s) specifically in the hopes of recovering damages. In parallel, the manufacturer should inform ALL dealers or servicers in writing about an upcoming change in policy.

The communication should include the following elements:

- Clearly define the issue

- Provide the business case for why a policy change (“control”) is necessary

- Instruct dealers or servicers what they can do to self-correct (e.g. training, using a specific part for a specific repair, going through a checklist before deciding to replace vs repair, etc.)

- Allow dealers time to self-correct

- Explain the consequences if a correction is not implemented

In practice, a large portion of dealers and servicers will self-correct, which will instantly lower claim costs. Those that don’t will need to have tight controls. A few control options are: placing a prior approval requirement on a specific repair type, having dealers return a specific part to a part return center for inspection after the repair is completed, or having technicians fully document each repair along with fault codes. A negative consequence of these controls could be longer repair times or lower dealer or servicer repair shop throughput and satisfaction. Therefore, the goal is always to focus these controls only on dealers that don’t follow through with self-correction.

In conclusion, a fraud analytics “deep dive” should be conducted every few years.

Even by implementing a solid fraud detection and prevention process that includes all five steps outlined above, fraud will continue to evolve. Dealers and servicers, whose sole focus is to “game the system” will come up with new ways to deceive manufacturers and consumers in order to pad their margins. In a down economy, fraudsters can become even more creative. Therefore, it is important to conduct a fraud “deep dive” every several years to uncover new fraud schemes, update rules-based claim systems, and implement new controls.

After, Inc. is a leader in providing warranty analytics solutions to manufacturers. We partner with some of the world’s top brands to help transform their warranty businesses, driving higher customer satisfaction post-purchase, higher product reliability, deeper brand equity and additional revenue / profit opportunities. Please visit our Warranty Analytics Solutions page to learn more: www.afterinc.com/warranty-analytics-solutions/ . Or feel free to contact us at 1.800.374.4728 or info@afterinc.com to discuss your specific warranty needs. We look forward to hearing from you.

Footnote: