Warranty Risk Management 101: Part 3- The Importance of Accurate Cost per Unit (CPU) Forecasting

How CPU Errors Can Significantly Impact Warranty Premiums, Reserves & Profits

Introduction

In Part 1 of our 4-Part Series, we introduced you to Warranty Risk Management and provided definitions for the key terms used in the risk management process. In Part 2, we discussed four categories of Warranty Risk Structures that manufacturers and retailers can employ to control risk and manage liabilities. We also highlighted pros and cons of each structure to help you make the right decision for your company.

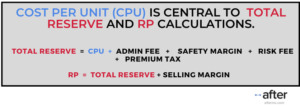

In Part 3 today, we will do a summary-level overview of cost per unit (CPU) forecasting. CPU is the central variable in the equations for a) “Total Reserves”, which are held by a manufacturer or retailer to cover claims, or “Premiums Paid” to the insurance companies to transfer the risk, as well as b) the retail price – or RP – charged to customers.

How Total Reserves and Retail Price are Calculated

Total Reserves is the amount that a manufacturer or retailer sets aside to pay for claims in an internal fund or to pay an insurance company in the way of Premium. Retail Price (RP) is what a manufacturer or retailer charges its customers for an Extended Warranty or Service Contract. As with most retail price calculations, Warranty RP is the sum of the wholesale price – “Total Reserves” in this case – plus a Selling Margin. Below is a graphic showing how both Total Reserves and RP are calculated. The RP shows the typical 100% markup from costs. (To review the definitions for each fee in the calculation, refer to the Definitions Chart in Part 1 of this Series.)

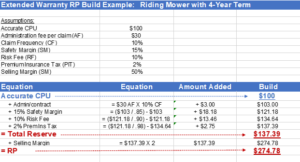

To illustrate how this works in real life, let’s take an example. Assume that you are a lawn and garden manufacturer that sells riding mowers. The cost for your mower is $2,000 and the cost to repair the mower for a four-year extended warranty term is $100.

How is the RP calculated? Below shows a RP “build” – and assumes a CPU of $100.

The equation starts with the CPU, and each subsequent step in the build uses a cumulative cost (CPU plus previous fees). The Total Reserve and RP calculations are therefore the result of this cumulative, multiplicative effect. As you can see from this example, if the selling entity requires a 100% markup (some do not, but many do), the customer pays nearly $275 to cover an average of $100 in claims costs (keep in mind that there are many reasons consumers purchase an Extended Warranty that make this a good decision). But watch what happens when CPU is wrong……

The Impact of Inaccurate CPU

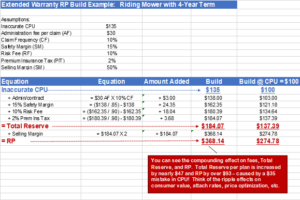

Let’s take the same example but assume the CPU forecast is wrong – it is $35 too high. How does that impact the Total Reserves and RP?

If CPU is overstated, like the example above, the contract will be over-priced and likely not sell as well. Additionally, Total Reserves will be inflated and cash flows that could be used elsewhere in your business will sit idle in the fund. If a manufacturer or retailer decides to transfer its risk to an insurer, this could lead to an even worse course of action. The insurer – believing that claims costs have risen due to faulty Warranty Analysis – will pass that cost through to the manufacturer or retailer and raise its premium. For any manufacturer or retailer, raising the premium from $137 to $184 per contract (see Total Reserve above) will have significant impacts on the Warranty Program and could even unnecessarily implode the program.

Overstated CPU’s have a large impact on RP. In the example above, when CPU is calculated $35 too high, RP is overstated by $93 due to the multiplicative effect. If the manufacturer or retailer increases RP, it could cause sales to decline significantly as consumers will be less willing to pay that high a price.

If the CPU is understated, the opposite occurs. The manufacturer or retailer sets aside less in Total Reserves (or insurer gets less in premium) to cover claims costs, and the business will be forced to raise cash to cover its obligations – and/or try to raise prices prospectively, which often doesn’t work well. An understated CPU will also lead to lower RP. While this might drive sales demand in the short term, it will cause major damage to program stability and the bottom line when the underfunded reserve is discovered.

What CPU related mistakes does After, Inc. normally see? In performing warranty related analytics for several clients across many different sectors, we have seen accurate forecasts (where we did not find significant room for improvement) exactly one time. About 90% of the time we find errors in claim emergence and/or overstated CPU’s – often grossly overstated – resulting in many optimization opportunities. The other 10% of the time we find errors in claim emergence and/or understated CPU, resulting in under-reserved programs; the largest of which was over $90 million underfunded.

Note: While our examples are focused on Extended Warranty programs, the analytic techniques apply equally to manufacturer’s warranty as well – especially where the manufacturer’s warranty is longer than one year and/or includes features and benefits in addition to traditional break/fix.

The Key to Accurate Risk Modeling

Forecasting accurate CPU and claim emergence is challenging for a multitude of reasons. First, with every new product, manufacturers may only have several months of field data, yet they must extrapolate a failure rate out for many months or years. In addition, parts and labor costs may constantly change, as well as product mix and technology. Additionally, products may have seasonal usage patterns due to climate changes and specific geographies, and/or exhibit “never seen before usage patterns” due to one-time events like a global pandemic (COVID-19).

Traditional survival analysis methods (Kaplan-Meier estimation, Weibull models and Cox regression) provide a good starting point for predicting claim frequency but do not address the following:

- Cost (or severity) of an event

- Recurrent events – the same event happening multiple times (used in social science and public health studies, but there is also significant application in warranty)

- Extrapolation

- Complex claim emergence

A combination of multiple types of models performed by warranty analysis experts – like After, Inc. – is the best way to ensure accurate risk modeling.

After, Inc. uses several different – client specific – modeling techniques to determine the most accurate methods to forecast CPU, claim emergence, ultimate run off, etc. We also partner with professors in leading universities to ensure that our models use the latest research in new mathematical techniques that are applicable to the work of accurate warranty forecasting. If the answer to your question “how do we calculate reserves or CPU” includes answers like: loss triangles, chain ladder, augmented chain ladder, or any of the ‘starting point’ methods mentioned above, you owe it to your business to explore alternative methods – they can be game changers.

We’ve said it before, but it deserves restating:

ACCURATE CPU IS ONE OF THE MOST IMPORTANT FACTORS IN SUCCESSFUL WARRANTY PROGRAMS AND RISK MANAGEMENT.

We hope Part 3 of our Risk Management 101 Series helped you understand the importance of CPU, its impact on Total Reserves and RP, and the difficulties in accurate forecasts. In Part 4, the next and final article in our Series, we will share a case study of a well-known manufacturer with a significant problem – an unforeseen increase in premium by its insurance company. We will outline how After, Inc. partnered to solve the problem – and save the program – so it is now well-positioned for success going forward.

Links to Part 1 and Part 2 of the Series can be found here:

Part 1: http://afterinc.com/2021/02/16/warranty-risk-management-101-a-four-part-series/

Part 2: http://afterinc.com/2021/03/04/warranty-risk-management-101-part-2-risk-structures/

To learn more about After, Inc.’s Warranty Analytics & Risk Management Services, please visit http://afterinc.com/warranty-analytics-solutions/.

After, Inc. (www.afterinc.com) has been offering Warranty Analytics, Program Administration and Risk Management Consulting – including captive set-up and management – to top tier manufacturing clients for over fifteen years. If you have any questions about Risk Management, feel free to reach out to us at http://afterinc.com/contact/. We look forward to hearing from you!